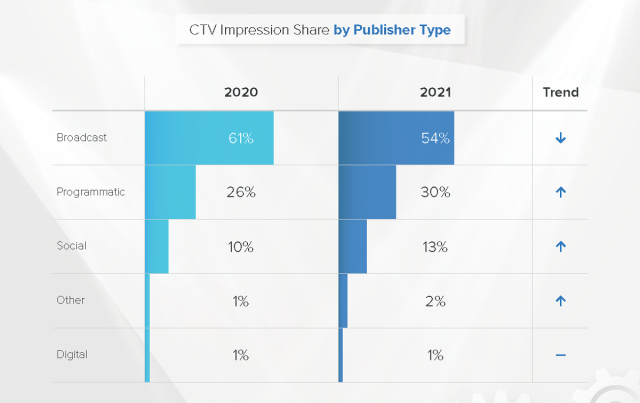

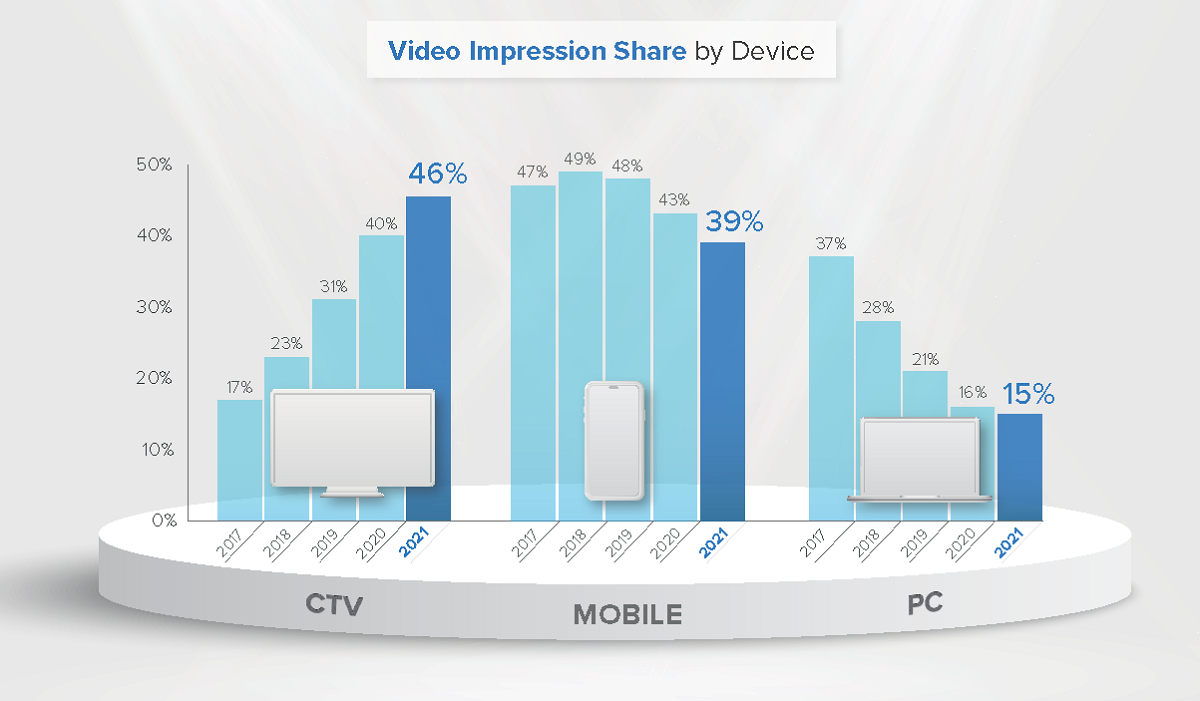

Converged TV devices are now the most dominant platform for video ad impressions, according to a new report from interactive video company Innovid. As more consumers have transitioned to streaming, advertisers are shifting spend to the channel, and that trend is expected to continue with mobile and desktop losing more market share.

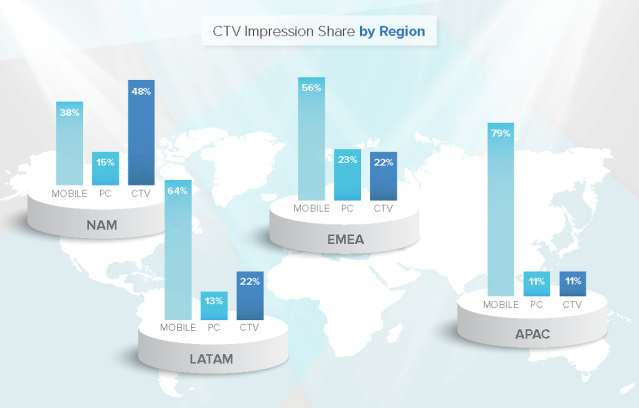

Innovid’s annual Global Benchmarks Report revealed that in 2021, CTV — a catch-all for digital and linear television convergence — surpassed mobile as the channel with the greatest share of global video impressions, with nearly half (46%), up from 40% in 2020. Meanwhile, mobile declined from 43% to 39%, showing that consumers continue to flock to streaming devices to consume content.

“The past two years have seismically changed consumer behavior and content consumption habits,” said Jessica Hogue, Innovid GM, measurement & industries. “Advertisers have had to keep pace with these changes while managing a roster of marketing tools, analyzing more data than ever before, and creating relevant, personalized experiences for their audiences.”

The study analyzed 286 billion video and display advertising impressions across channels served on Innovid’s platform in 2021.

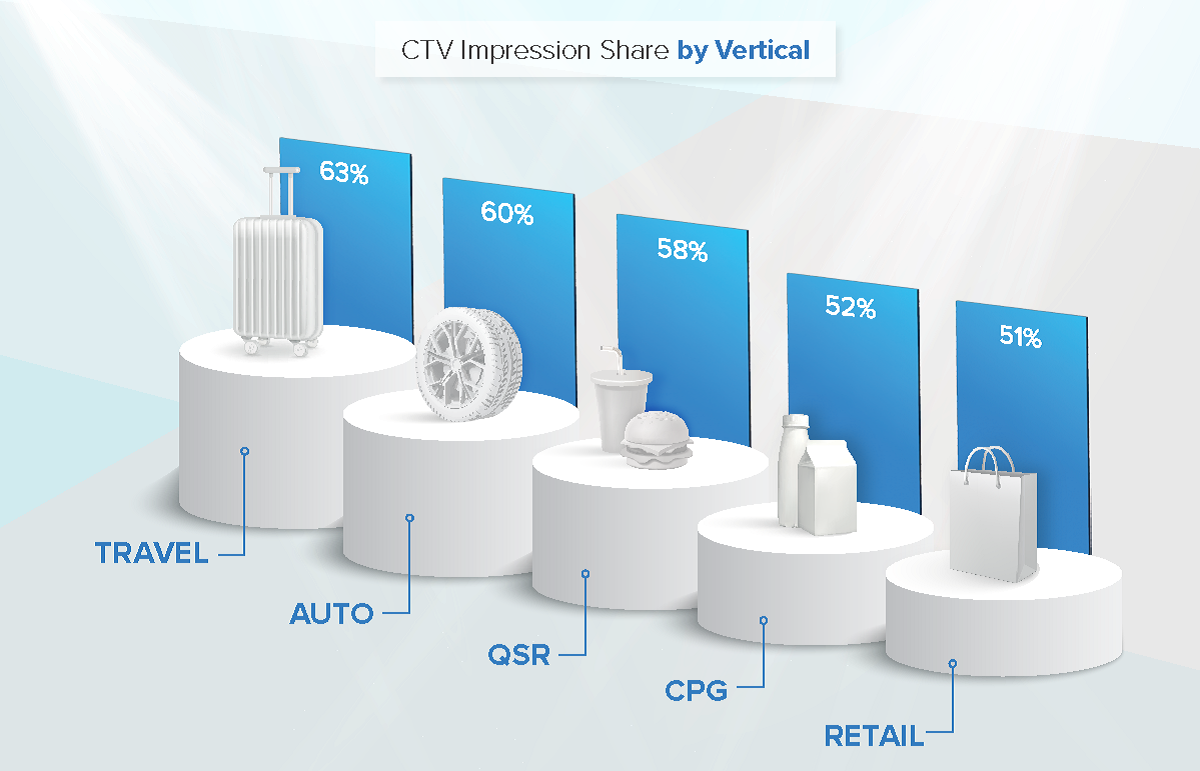

It found that every vertical increased its video contribution to CTV ads with Travel leading the way with 63% of CTV video impression share, followed by Auto (60%).

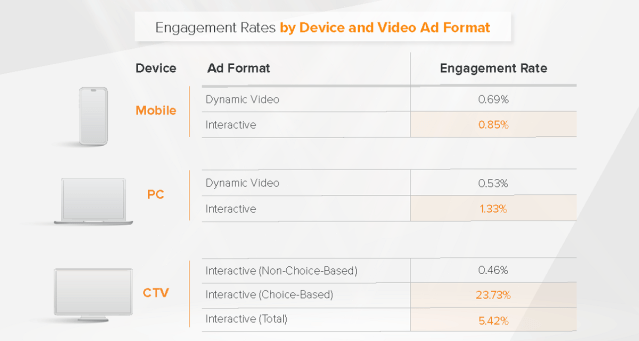

Across the board, advertisers tapping into what Innovoid calls “advanced creative” earned an additional 47 seconds of time in 2021, up from 34 seconds last year. Interactive CTV led the charge, generating an incremental 72 seconds of time earned between brands and consumers.

QR code units continue to grow in popularity, providing a 0.02% scan click rate and high intent and follow-through from the audience.

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities

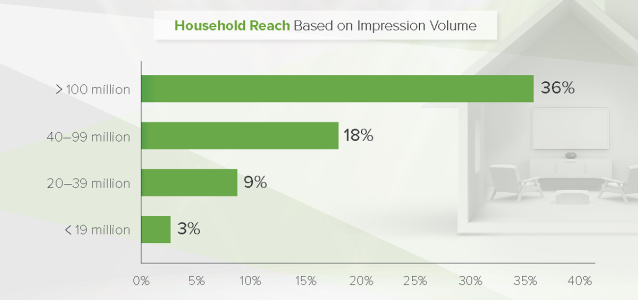

The study also found that CTV campaigns reached, on average, just over 9% of the 95 million CTV households that Innovid serves, highlighting “a massive runway for advertisers when it comes to CTV reach,” Hogue added.

“The study showed a low level of ad frequency, indicating considerable leeway for advertisers to reach new households without risking oversaturation.”

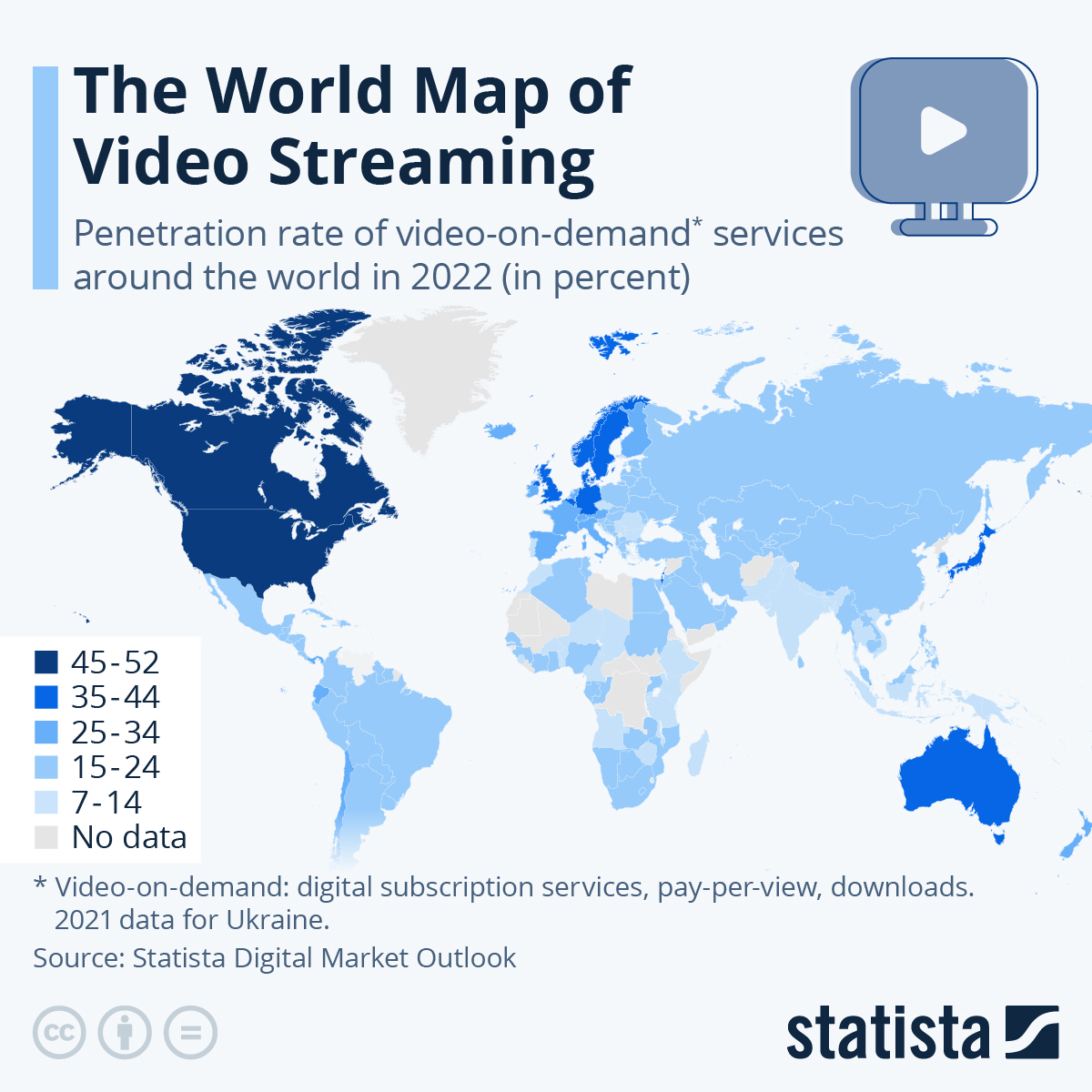

A Map of Worldwide SVOD Penetration Rates

Facing a rising number of competitors, Netflix has found it difficult to grab more share in the streaming marketplace and recorded its first decline in its subscriber base since the first quarter of 2022. However, worldwide growth of SVOD services rose roughly 20% in 2022, according to market research & analysis consultancy Statista.

As Statista senior data analyst Katharina Buchholz explains, the map below shows “the most promising markets for chasing video-on-demand users are now South Asia, Latin America and Africa, where Disney+ has arrived in several countries (including South Africa) in 2022. While the market is expanding more slowly in North America, where video-on-demand has reached approximately 50% of the population, there is still some more room to grow in Europe, where this figure varies from 14% in Bulgaria to 42% in the United Kingdom.”