READ MORE: The Value of Video to Pay-TV (TiVo)

There’s hope yet for struggling pay TV operators if they can evolve their service to incorporate OTT delivered services and a more efficient delivery platform, according to TiVo.

The set-top-box, cloud platform and TV recommendation engine has engineered its latest report to suggest its products hold the solution to the pay TV operator’s dilemma.

“Despite the negative trajectory of the business, pay TV is too essential to the overall service bundle for operators to contemplate abandoning it,” the report advises. “Instead, they must invest in improving the performance of their video service — and determine the investment strategy that makes the most sense for their business.”

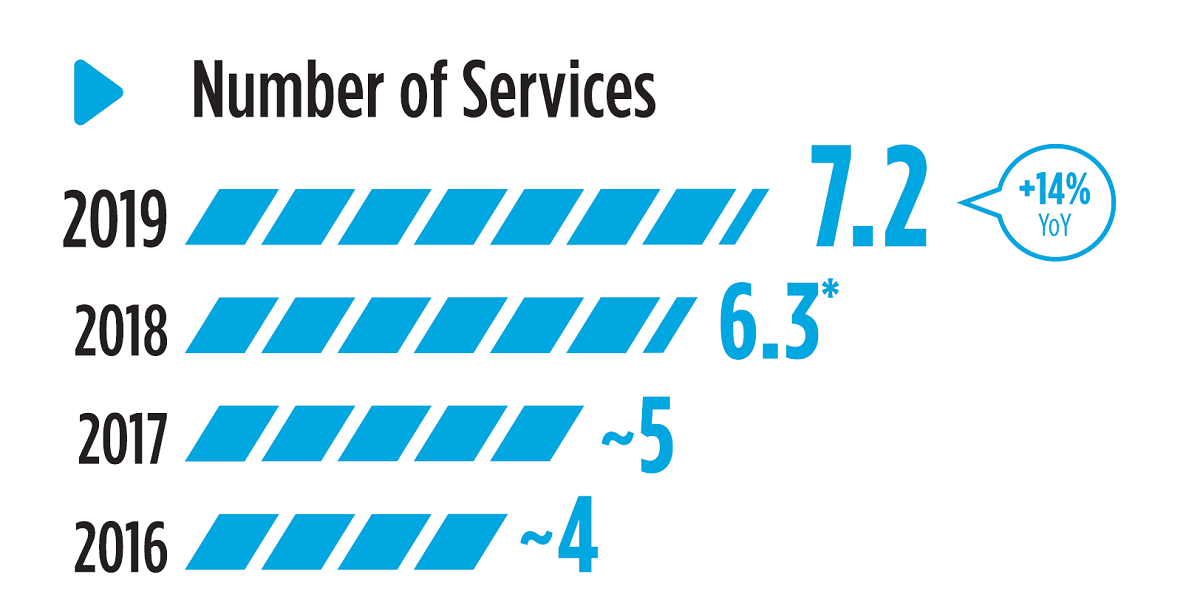

TV subscribers of SVODs or the traditional cable-satellite package certainly want a change. Juggling multiple TV services is beginning to take its toll.

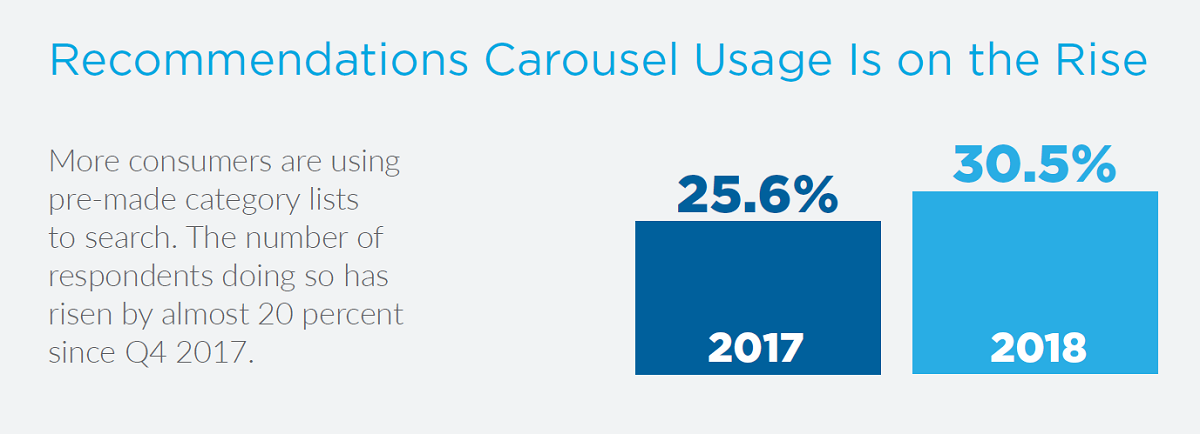

Per the report, three-quarters of respondents say they want universal search, a function that allows viewers to make a single search query across all their TV services. Moreover, two-thirds choose the video service they are going to use based on the ease with which they can find something to watch.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

Pay-TV customers, most of whom use SVOD services, are also looking for help. 86% say they want a single access point for all their video content.

“In a sign that consumers are learning to appreciate the simplicity of the big bundle, their interest in à la carte is waning for the first time in years,” TiVo suggests.

Between 2017 and 2019, the number saying they wanted the à la carte option took a sharp dip, from 81% to 70%.

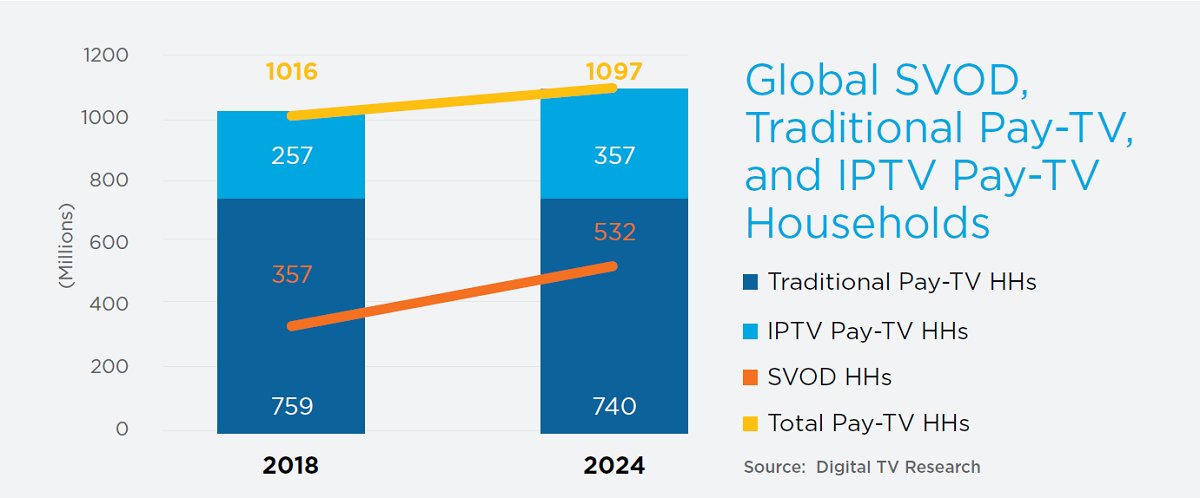

That said, and despite the massive growth in SVOD services, nearly three-quarters of US homes still have a pay-TV subscription.

What’s more, their use of the service far outstrips viewing through SVOD services. According to stats in the report 216 million regular TV viewers watch, on average, seven billion hours each week. About 104 million connected TV users watch seven times less, and 161 million smartphone video viewers watch almost 20 times less.

“Eroding pay-TV margins and customer base are negatively impacting the bottom line for many service operators,” it concludes. “They are rethinking their approach in order to maintain and improve customer lifetime value.”

— TiVo

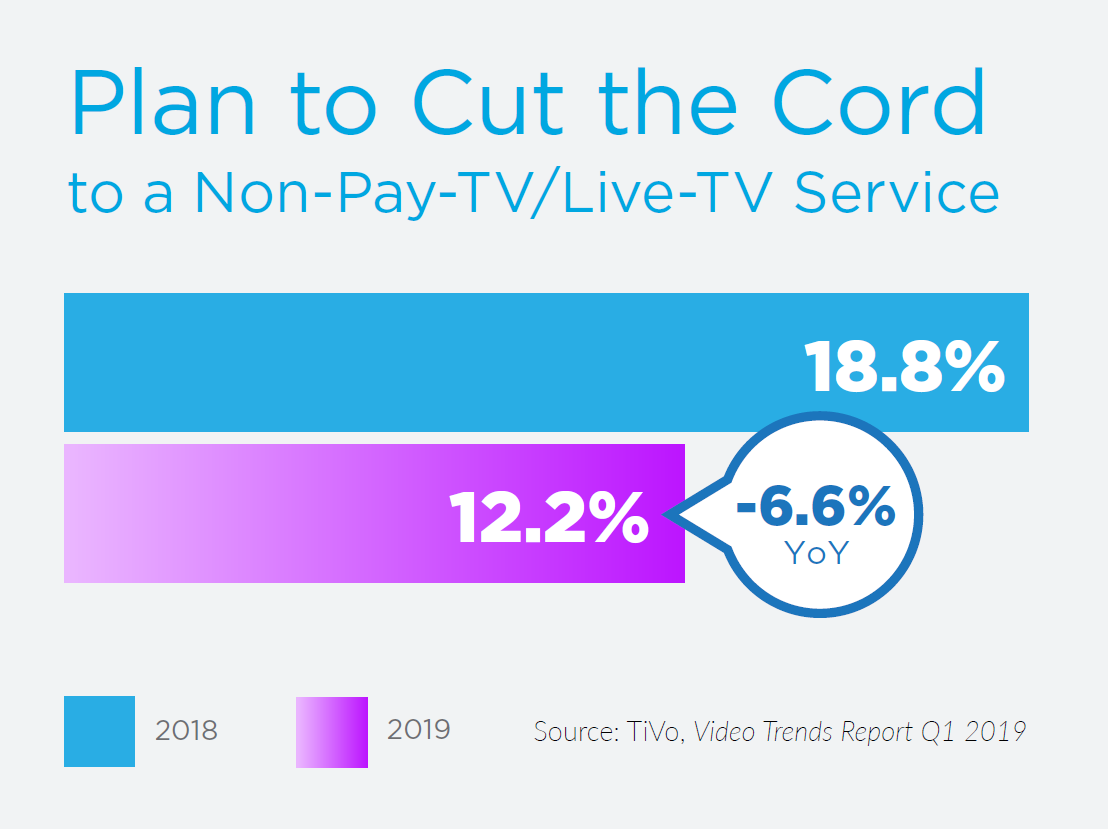

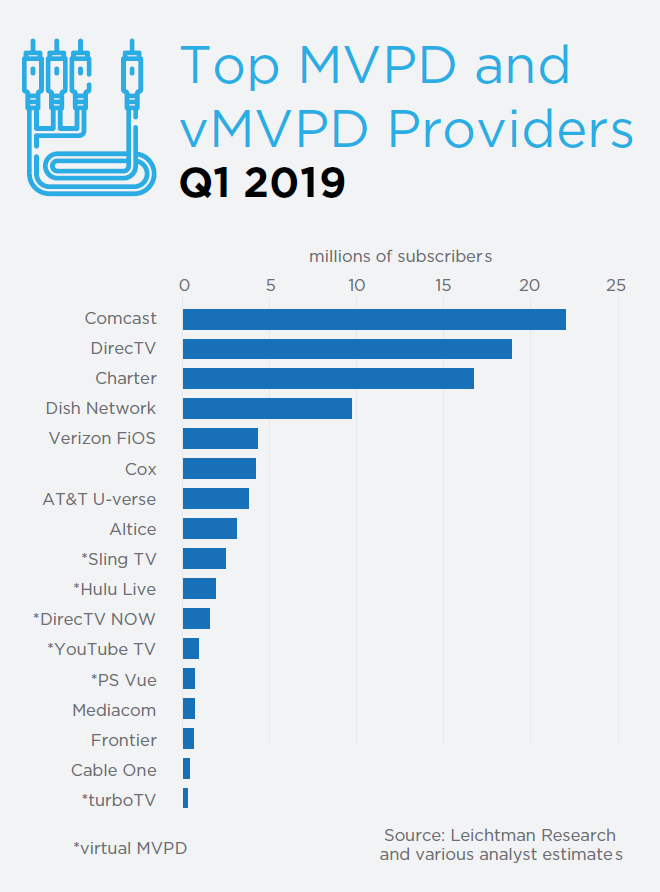

Yet cord cutting continues as more and more consumers move to cheaper alternatives for their TV. The report highlights the likes of YouTube TV and Sling TV — dubbed Virtual MVPDs (vMVPDs) in the jargon — as allowing consumers to save money while retaining access to some, but not all, of the TV channels they love.

Sling TV, for instance, is now the ninth-largest pay-TV provider in the US, with 2.5 million subscribers. Hulu Live, AT&T TV Now, YouTube TV and PlayStation Vue are the next four largest pay-TV providers in the country.

As a result, according to TiVo, pay-TV operators are looking for options to allow them to combine their physical-based pay-TV solution with IP services at the set-top-box level. Since most of their customers are SVOD users too, they are looking to integrate online TV services into the pay-TV experience.

“Like it or not, for an increasingly large group of consumers, vMVPDs are a viable alternative to your pay-TV services,” TiVo insists. “Large parts of the attraction are the low price and flexibility these services offer.”

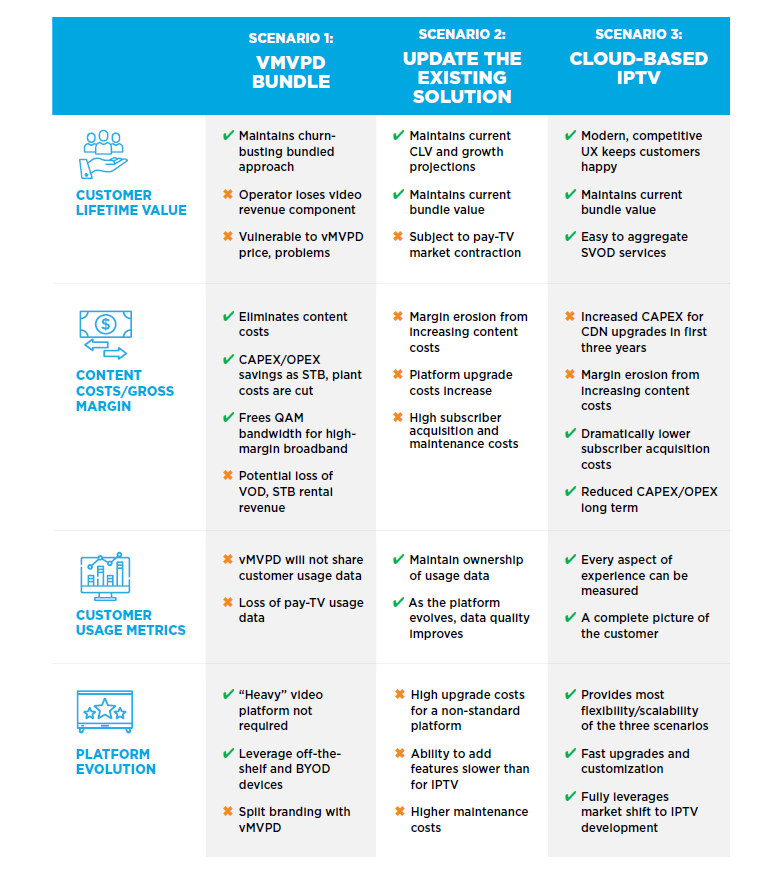

TiVo outlines a number of options for the pay-TV operator, including allowing customers to purchase their own set-top-box (hey, such as TiVos) or to move to a cloud-based IPTV delivery, which TiVo also offers and says seems to provide the most significant improvement in customer usage metrics.

“Eroding pay-TV margins and customer base are negatively impacting the bottom line for many service operators,” it concludes. “They are rethinking their approach in order to maintain and improve customer lifetime value.”

The message is clear. Though consumers like having more choices, they also value simplicity and convenience.