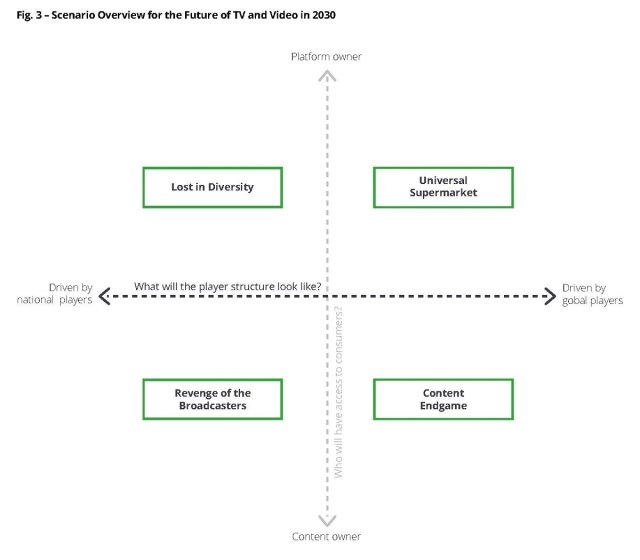

By 2030 a handful of global digital platform companies will control every aspect of media from production to customer with national broadcasters all but extinct. This dystopian scenario is one of four possible outcomes for the TV and video industry predicted by Deloitte.

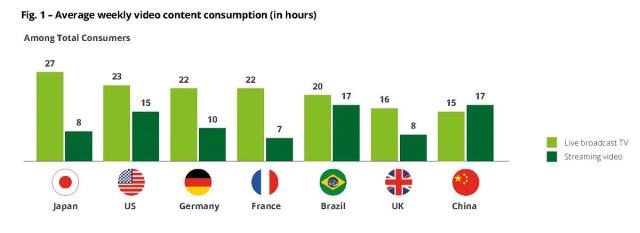

The consultant identified four trends likely to shape any mid-term future for the industry. They are not eye-opening until you view the extrapolation Deloitte makes from it.

- Digitalization is fundamentally changing production processes and the distribution of content. IP and 5G are enabling more mobile consumption of content. These are being joined by new AI recommendation and analytics to address consumers in a targeted way.

- VOD gains ground, but linear TV continues to assert its role in live content such as sports and major events.

- TV and video advertising adapts to new formats and relies more and more on the personalization of advertising content.

- Market regulation in the media industry will be more moderate than it is today. In particular in the area of online and mobile services, this will reduce the regulatory pressure on all market participants, especially on traditional media companies.

So where does this leave us in nine years’ time? Here are the four pictures painted by Deloitte.

Universal Supermarket

By 2030, broadcasting as we know it today has disappeared. Broadcasters have been through a painful process of change and evolved into pure creators of largely national or specialized content, without any stakes in distribution or customer relationship. They are now a supplier of their own channels and streams to a few global digital platform companies’ universal supermarket.

Deloitte surmises that the financial capabilities of the global digital platform companies allowed them to acquire exclusive sports rights and produce global blockbuster content, displacing smaller players such as broadcasters and content creators. Since advertising has also shifted to the digital platforms, broadcasters are dependent on revenue shares and cut off from direct paid content and commercial venues. However, consumer demand for relevant content such as news or local(ized) formats has saved the broadcaster from extinction.

In the Universal Supermarket scenario, regulators did not take significant steps to monitor and control the digital platform companies’ market strength. Content brands should seek more international licensing and leverage. To secure additional revenue streams, broadcasters and content producers must extend their business models beyond the TV and video market into other fields, such as merchandising.

Content Endgame

In this future scenario, large global content owners are the winners. They’ve integrated vertically along the entire value chain and started to withdraw and withhold content from digital platform companies and distribute via their own channels, bypassing the platforms and establishing direct customer relationships.

Smaller producers have been pushed out of the market. The variety of content has decreased, but the quality of global productions has reached new dimensions. Big content owners with strong program brands and global reach target a global audience with costly blockbusters and benefit strongly from economies of scale.

“This forces digital platform companies into becoming pure distribution channels, focused purely on technical delivery. Their business model has changed fundamentally, since consumers are no longer paying for a specific platform, but directly for their preferred content.”

To win here, larger content producers need to invest more strongly in international content production directly or via subsidiaries to keep pace with their big global counterparts, Deloitte urges. They must also strengthen customer relationships and advertising marketing. Smaller broadcasters and content producers need to position themselves as “inimitable national partners for global players through unique, local, and strongly branded content.”

Revenge of the Broadcasters

In what must be the least likely outcome, national broadcasters have successfully accomplished their digital transformation, established direct customer relationships and excel at delivering on-demand content. They’ve also developed excellent digital capabilities and entered new services such as targeted advertising and recommendation functions. Furthermore, the high relevance of content for a national audience puts broadcasters in a superior market position, supported by regulatory measures such as content quotas.

National broadcasters and global digital platform companies coexist in the market. While national broadcasters focus on local quality content, digital platform companies supply global productions and blockbusters.

All this is predicted on strong media regulation at a national level, strict national and European regulatory regimes to counter the threat of globally dominant streamers and widely accepted measurement systems.

Lost in Diversity

This scenario depicts a diverse ecosystem with no dominant players but still a decent return for broadcasters. Everyone does everything in this scenario: Global digital platform companies have established direct customer relationships. Telcos, broadcasters, and content producers have also successfully created their own digital platforms. Digital platform companies contribute global formats such as high profile series. To provide relevant local content they also forge alliances with local producers.

Network operators act as super-aggregators. They provide access to content and structure the market from the customer’s perspective by offering guidance across platforms. National broadcasters capitalize on the consumers’ huge appetite for local news, sports, movies, and series. Broadcasters who started their digital transformation at an early stage are using their own platforms for content distribution. Others have established partnerships with platform providers, with the general trend towards co-productions between broadcasters and global digital platform companies.

All in all, national broadcasters remain independent and maintain their livelihood by various revenue streams. In this vivid and dynamic market, advertising agencies continue to have a high relevance. They systematically allocate ad budgets and provide guidance within the complex TV and video ecosystem.

“In a world in which everyone does everything, only a strong focusing strategy and appropriate investments secure the future market existence of broadcasters and content producers,” Deloitte advises.