NAB Amplify has published a market perspective titled “The Media and Entertainment Market: 2021 Outlook” designed to help this community understand and navigate the shifting media and entertainment landscape.

Download the full research report here.

The Unavoidable Impact of COVID-19

COVID-19 has had a seismic impact on the industry, and its full ramifications may not be known for several years. However, we do know that the global pandemic has accelerated many of the positive and negative trends already identified in the media and entertainment market and made the ecosystem even more difficult to navigate.

The virus has touched every aspect of the industry, from the way we produce and distribute content to the rapidly changing nature of consumer consumption and behavior. The document contains NAB Amplify’s view of the shifting landscape, providing an evidence and data framework designed to help and support those in the media and entertainment business.

The market decline has been sharp in 2020, with COVID-19 halting production of TV shows and movies as well as shutting down cinema chains—in some cases for good. Meanwhile, consumers have continued to build their own media bundles, where they will pay for content they want to view.

This trend will continue to drive growth in digital aspects of the market at the expense of traditional broadcast channels. However that sustained consumer demand; technological advancements; the return of production activity; and commensurate growth in advertising spend should lead to a strong bounce back once the second pandemic lockdown phase is lifted.

Everyone in the marketplace knows digital ad spend has overtaken that on TV/video in recent years—and digital spend will be relatively less affected as we move through and out the other side of the coronavirus crisis. Estimates from Group M and NAB suggest digital dollars are expected to decline 2.4% in 2020 with an 11.3% incline going into 2021, while TV/video advertising is expected to fall by 17% in 2020 with an increase of 6% moving into 2021. Digital ad spend amounted to 19% of the marketplace in 2012; by 2024 it is expected to increase to around 60%.

New Formats, Behaviors and Workflows

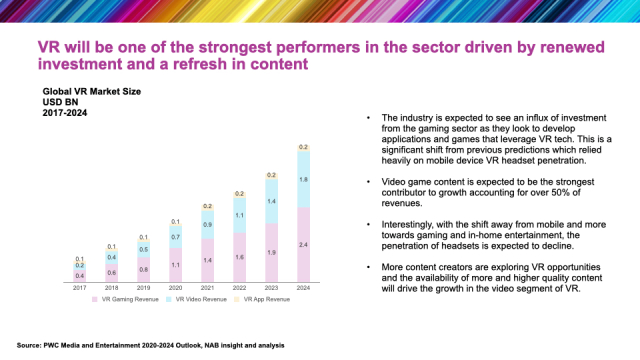

We are all aware of key trends that were present in the marketplace before COVID-19 struck: consolidation among traditional media companies; the rise of new formats and technologies such as cloud, 5G, AI and VR; consumer preferences driving the rise of OTT and streaming; and a commensurate surge in personalization, as consumers no longer want one-size-fits-all media and entertainment experiences.

Broadcasters around the world are altering their approach to technology spending with plans to purchase private or hybrid public cloud solutions, which accelerates the move from capex to opex and disrupts traditional tools.

The pandemic has unquestionably accelerated this trend, as crew sizes have been reduced and both staff and freelancers are required to work remotely in order to ensure safety and social distancing at all times. Cloud approaches are of course a key enabler in this area, and are here to stay as the working from home (WFH) culture is embedded during this time.

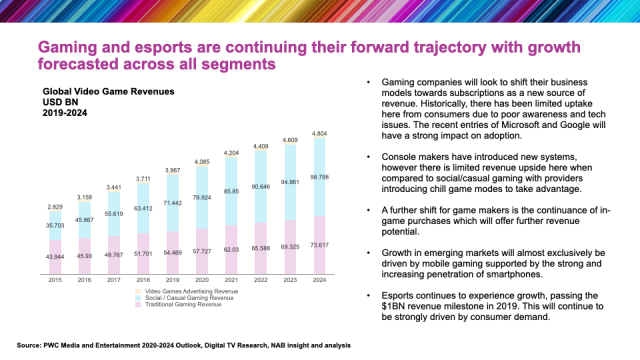

Digital-first areas like OTT, video games, esports and VR have not been hit as hard as other aspects of media and entertainment. Social and casual gaming will continue to outstrip traditional gaming revenue, while esports continues to surge with an important $1bn revenue milestone being passed in 2019.

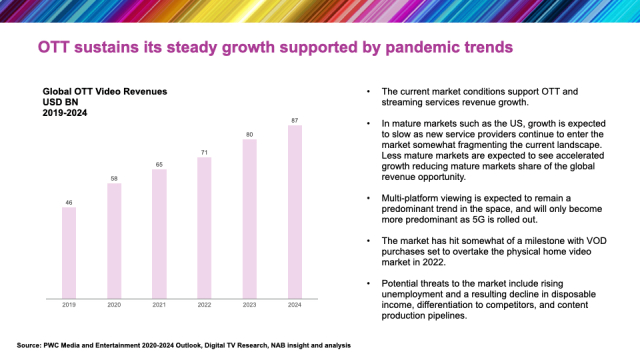

Consumer demand for formats that allow them to engage with content from their own home has never been higher as a result of the pandemic. This coupled with the roll out of 5G will continue to drive growth whilst disrupting traditional formats. The global market for OTT and streaming platforms is expected to grow from $104bn to $161bn, as the boom in home entertainment pays dividends with consumer subscriptions.

The desire of the ad market for data-driven, targeted evidence will continue to push it towards digital channels. Naturally, during the financial crisis that has accompanied the global pandemic ad spend has shrunk, but this spend is typically resilient and should drive much of the growth in the anticipated market recovery through 2021.

Creating and Consuming Media

In terms of the overall business model, in the media and entertainment ecosystem, the pandemic has significantly altered how consumers access and consume their media. Live venues such as sport and music arenas have been closed.

This has created a gap in existing business models, which will be filled by various forms of digital-led content even as live venues re-open and fans return to take their seats once more.