TL;DR

- With the advent of ad tiers on all major SVOD services, streaming TV is finally coming full circle.

- Parrot Analytics argues that for a decade SVOD platforms have been largely propped up by broadcast networks.

- Broadcast viewership has shrunk but its influence remains potent, with 15 of the 100 most in-demand TV series across all platforms year-to-date worldwide originating on broadcast networks.

- Broadcast content consistently appeals to broad audiences — at a fraction of the cost — during a time when streamers are battling for every last subscriber in a hyper-competitive market.

- Broadcast and linear networks are part of a virtuous cycle of content and are still the easiest way to reach large swaths of American audiences at a given time.

READ MORE: Parrot Perspective: The Value of Broadcast TV (Parrot)

To misquote a Monty Python sketch: “TV isn’t dead, it’s resting.” With the advent of ad tiers on major SVODs, all the talk is of streaming TV coming full circle.

Rather than disrupting the decades-old business model of getting moving picture entertainment into the home, streamers have been forced to realize that it was just TV all along.

Parrot Analytics goes a step further and says that the streamers have been propped up by broadcast for a decade. While it’s true that viewership to linear TV — notably the four US major networks — has shrunk in that time, its influence remains potent. Indeed, much as exhibition amplifies the overall take of the latest blockbuster in ways that no amount of publicity or streaming subs can buy, screening on TV amplifies the audience for content watched on-demand.

“Law & Order and NCIS aren’t sexy in an era of blockbuster franchise IP featuring superheroes and Jedi,” Parrot notes. “But broadcast content consistently appeals to broad audiences — at a fraction of the cost — at a time when streamers are battling for every last subscriber in a hyper-competitive market. Network titles are proven to fit well within the ad-supported format that is rapidly overtaking the OTT market.”

Parrot provides a wealth of stats to back its analysis up. For example, 15 of the 100 most in-demand TV series across all platforms year-to-date worldwide originated on broadcast networks. That number rises to 23 in the US alone, “a signifier of how significant the cultural footprint of these shows can truly be, particularly in the highly competitive domestic market.”

This creates a unique opportunity for streaming. In particular, broadcasting helps drive demand and retention. This becomes an obvious case when looking at broadcaster owned streamers (BVODs) such as Hulu, HBO Max or ITV Hub (soon to be ITVX) in the UK.

Variety’s Selome Hailu shares how the season two premiere of CBS’ sitcom Ghosts (adapted from the BBC show of the same name) saw a 50% increase in viewership after seven days of multiplatform availability, reaching a peak US demand of 16.67 times in that span. The show, nestled comfortably in the digital shelves of Paramount+, can now help serve multiple purposes for the company as a linear hit and streaming attraction — all for the convenient price of one show.

READ MORE: CBS’ ‘Ghosts’ Season 2 Premiere Hits Top Comedy Episode on Paramount+ (EXCLUSIVE) (Variety)

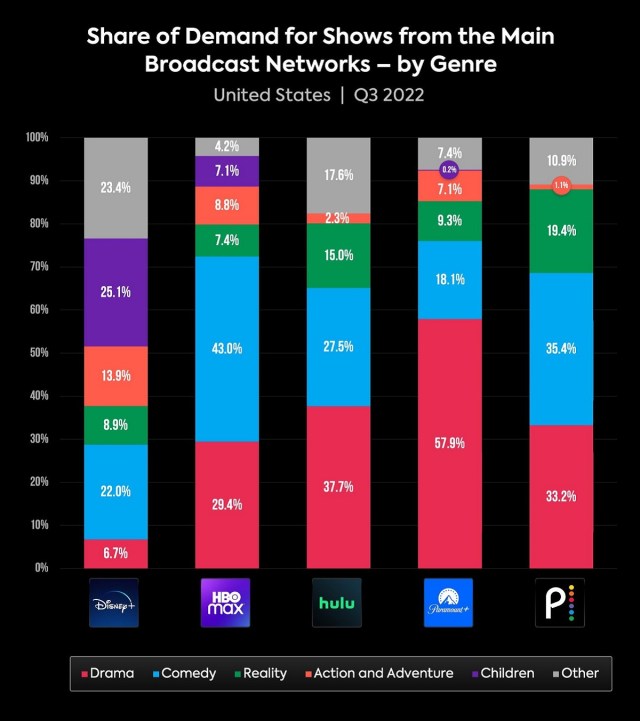

In fact, Parrot finds that broadcast titles make up a significant percentage of catalog demand for major streamers such as Peacock Premium (42%), Hulu (33.8%), and Paramount+ (30.1%). The decay in linear viewership is partially ameliorated as these viewers migrate to broadcast network’s streaming siblings.

Netflix initially grew its subscriber base by drawing in audiences to perennial favorites like The Office (NBC/BBC), Seinfeld, and Friends (NBC) — while paying titanic sums for streaming rights, of course.

HBO Max houses CBS originals The Big Bang Theory and Young Sheldon, two of the most popular sitcoms in recent memory.

In Parrot’s view, these easily digestible titles serve as both passive and active viewership offerings with a hefty back catalog of episodes to keep users engaged frequently and long-term.

“As such, they are excellent retention contributors and churn reducers for their respective streaming homes. A hit multi-season sitcom often provides a long-tail of sustained usage and rewatchability.”

It’s also why streamers are commissioning new sitcoms (e.g., Apple TV’s Ted Lasso). This format and series are particularly useful as streaming platforms adopt ad-supported tiers “that resemble broadcast formatting in an attempt to increase their total addressable markets.”

Broadcast TV content is generally cheaper too. Parrot contrasts the $20 to $30 million per episode for shows like Netflix’s Stranger Things, Amazon Prime’s Lord of the Rings or HBO Max’s House of the Dragon with the sitcoms, police procedurals and true crime dramas of TV.

“Pound-for-pound, the biggest broadcast series are still eliciting similar enough audience demand as the top SVOD series for significantly less cost.”

In an interview with Joe Flint at The Wall Street Journal, CBS CEO George Cheeks said as much in September: “If I’m being candid, I’m not looking to find a $20 million-an-episode premium drama.”

READ MORE: TV Networks Have a New Role: Farm Teams for Streaming Shows (The Wall Street Journal)

Meanwhile, Paramount chief financial officer Naveen Chopra shares with Dade Hayes at Deadline how “a lot of pure-play streamers have to spend billions of dollars a year renting library content. We have that in-house. Library content is responsible for a large share of viewing on streaming services and it’s critical to subscriber retention.”

READ MORE: Paramount Shares Wobble On Q1 Results; Wall Street Hasn’t Fully Embraced Its Streaming Story (Deadline)

That’s not to say that less expensive broadcast series are inherently more valuable than their more expensive streaming original counterparts. Flagship SVOD exclusives drive growth by attracting new subscribers.

“But it’s often the broad reach of library network content with high demand that retains these customers and ultimately reduces churn,” Parrot analysts say. “The two tiers of content work in tandem to create tailored value for a service.”

Studios should continue exploring multiplatform distribution flexibility, Parrot advises. “Much like how streamers use broadcast to showcase their originals, streamers can also allow users to sample select originals via FASTs.”

Read It on Amplify: FAST TV and SVOD Are “Channeling” the Cable Business Model

It further suggests that every new Peacock Premium original should make its pilot available to view on the service’s free ad-supported tier. Once a Prime Video series reaches three seasons, the first season should be made available on Freevee (which already licenses dozens of linear series).

In another suggestion, when a new South Park Paramount+ movie arrives, the preceding original film should become available on Pluto TV for a month (Showtime recently launched a channel on the FAST platform in order to expand its reach). “These flywheel efforts will serve as a growing discovery gateway for viewers.”

In sum, the death of TV has been grossly exaggerated — just as SVOD was given premature obits last spring. There’s a virtuous cycle that could be to the benefit of both.

“Broadcast and linear networks are still the easiest way to reach large swaths of American audiences at a given time. They’re necessary platforms to help cut through the noisy clutter of an entertainment industry that is on pace to air more than 600 scripted series this year.”

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- Connected TV Takes Over the World

- Connected TV Is the New TV, and That’s Where We Are

- FAST TV and SVOD Are “Channeling” the Cable Business Model

- More Consumers Are Headed Into the FAST Lane

- SVOD vs. AVOD Today, All Connected TV Tomorrow

- Ways Pay TV Operators Can Win the SVOD Game