READ MORE: FASTs Are The New Cable (TV Rev)

It is only a matter of time (2023 at the latest) until all the SVOD services follow Paramount+ and Peacock’s lead and roll out their own linear OTT channels.

So say analysts TV Rev in a new report, “FASTs Are The New Cable,” which aims to establish that free ad-supported streaming TV channels are the new cable TV.

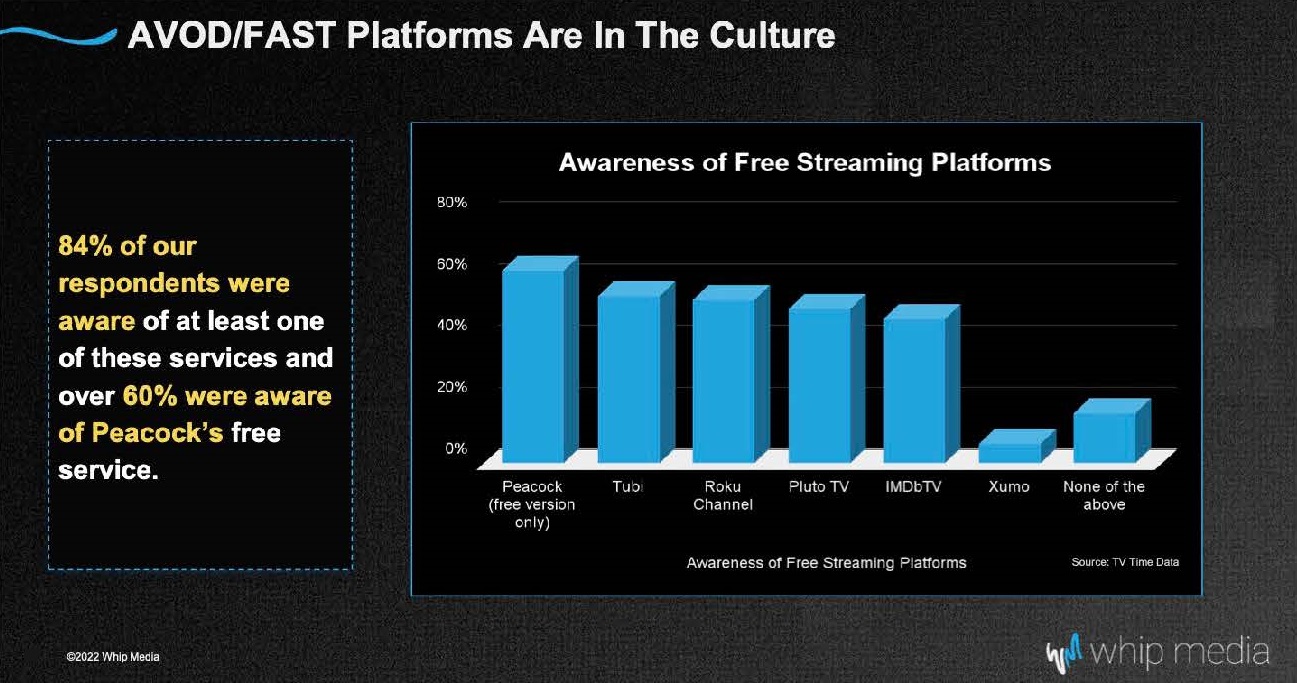

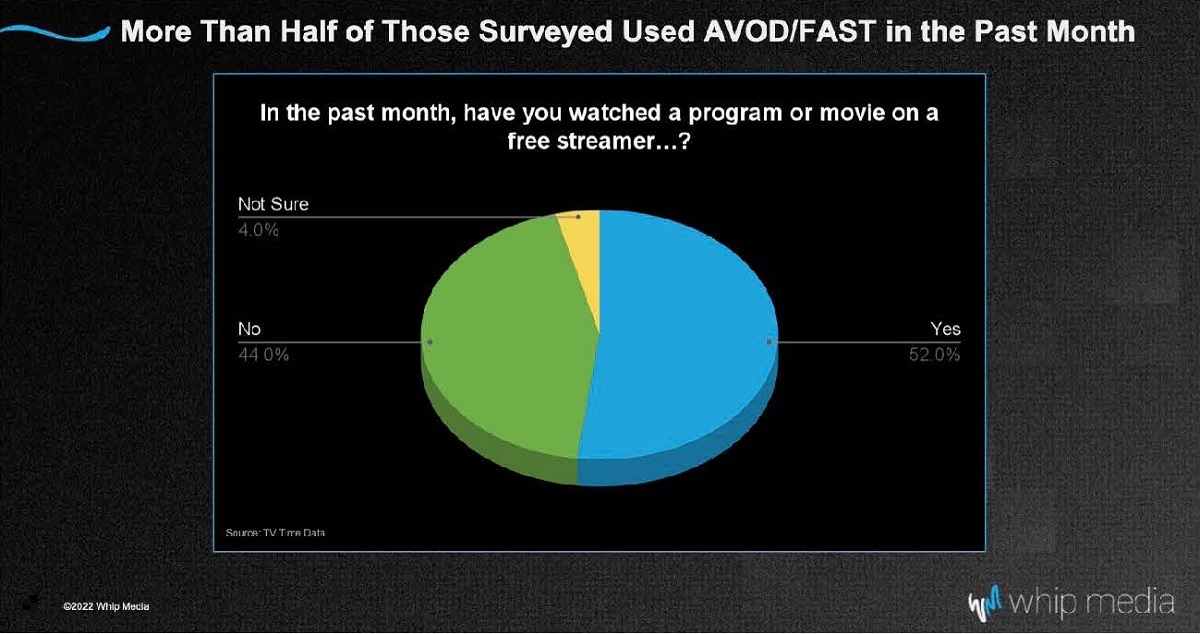

The FAST ecosystem is evolving quickly, gaining enormous popularity among consumers for the wide array of options, while providers appreciate the ease of setting up a service app.

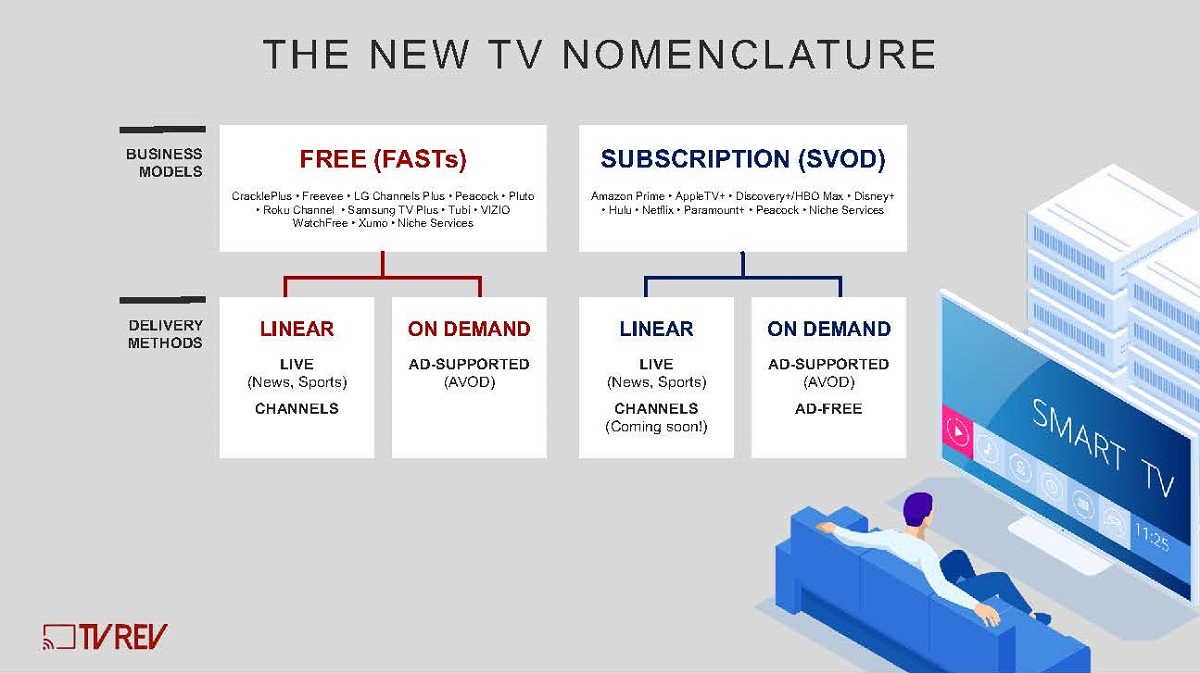

The main distinction appears to be between FAST, which mimics the linear EPG of old, and SVOD, the subscription on-demand model that a decade ago seemed the only OTT business model winner.

But not so fast. Almost all services now have linear and on-demand options, TV Rev finds. The FASTs all have linear channels and on-demand offerings, some favoring one option more than the other. And with the addition of live sports and news, most of the major SVOD services now have linear and on-demand options as well.

“While ‘FAST Channel’ is most definitely the term currently used to describe linear channels on FAST services, the appearance of linear channels on SVOD is likely to result in a shortening of that term to ‘Channel’ across both business models,” the report explains.

There’s also a distinction between ad-free and ad-supported. Both are now options on all of the eight major SVOD services.

Summing that up:

- FAST and SVOD are the two key business models.

- Each delivers content via linear channels and on-demand options.

- While FASTs are always ad-supported, SVOD can be either ad-supported or ad-free.

TV Rev’s excellent report explores the FAST ecosystem, shedding clarity on what can be viewed as a confusing set of trends, including the battle over the interface, curation vs. licensing, and how even TikTok is jumping on the FAST bandwagon.

The FAST Players

One of the biggest battles being fought right now in the television industry is the battle over the interface, specifically which interfaces will prevail and which companies will provide those interfaces to the hundreds of smaller TV manufacturers worldwide who don’t have resources to create their own.

Duking it out are smart TV OEMs, such as Samsung, LG and VIZIO, along with connected device manufacturers like Roku, Amazon, Google and Apple. There are also new players like Toshiba, Comcast and Walmart, who may use a third party interface (Android) as a base, but whose design and content decisions are their own.

“Whoever controls the interface for the TV also controls which apps are allowed on the interface, which means they get to wield a great deal of power and become the new gatekeepers for the streaming ecosystem,” says TV Rev. “This gives them a lot of power over the FASTs, similar, in fact, to the power the MVPDs once had over cable networks.”

“Linear channels plus superior viewer data should allow at least one FAST to experiment with a channel based on prior viewing habits — something similar to the way Spotify creates personalized playlists based on your recent listening selections. It’s certainly worth a shot and if successful, would increase engagement.”

— TV Rev

Into the mix come service aggregators, which corral content from a number of different sources and maintain fairly extensive libraries of programming, delivered both linearly and on-demand.

The main ones considered by TV Rev are the four media company-owned services: Pluto TV (Paramount), Peacock (NBCU), Xumo (Comcast) and Tubi (Fox).

There are also device and OEM-owned aggregator services such as Freevee (Amazon), The Roku Channel (Roku), LG Channels (LG) and Samsung TV Plus, along with independent services like Plex and Crackle Plus.

A step down are single-publisher apps, which, as the name implies, have content from a single publisher or studio. Examples include new apps like Cheddar, the History Channel app, or independent apps like Future Today, which specializes in kids and family entertainment.

Then there are the content providers — everyone from Filmrise and A+E to This Old House and The Hallmark Channel. These providers may also maintain their own unique apps, but they have also struck deals to have the aggregators distribute their programming.

This is a broad and rapidly growing category as rights holders see that they can get much broader distribution for their content by striking deals with numerous aggregators.

“For cable networks, distributing programming via their own dedicated channel on the various FAST services appears to be a much smarter move than trying to make their own TV Everywhere apps happen,” says TV Rev.

The report quotes a senior content executive, who states, “It’s just a lot easier to strike a deal with say Pluto TV, The Roku Channel and similar services, and have them handle distribution. You avoid the costs of having to maintain and promote your own app and you get much wider distribution which translates to more ad revenue. So it’s an easy decision for most rights holders.”

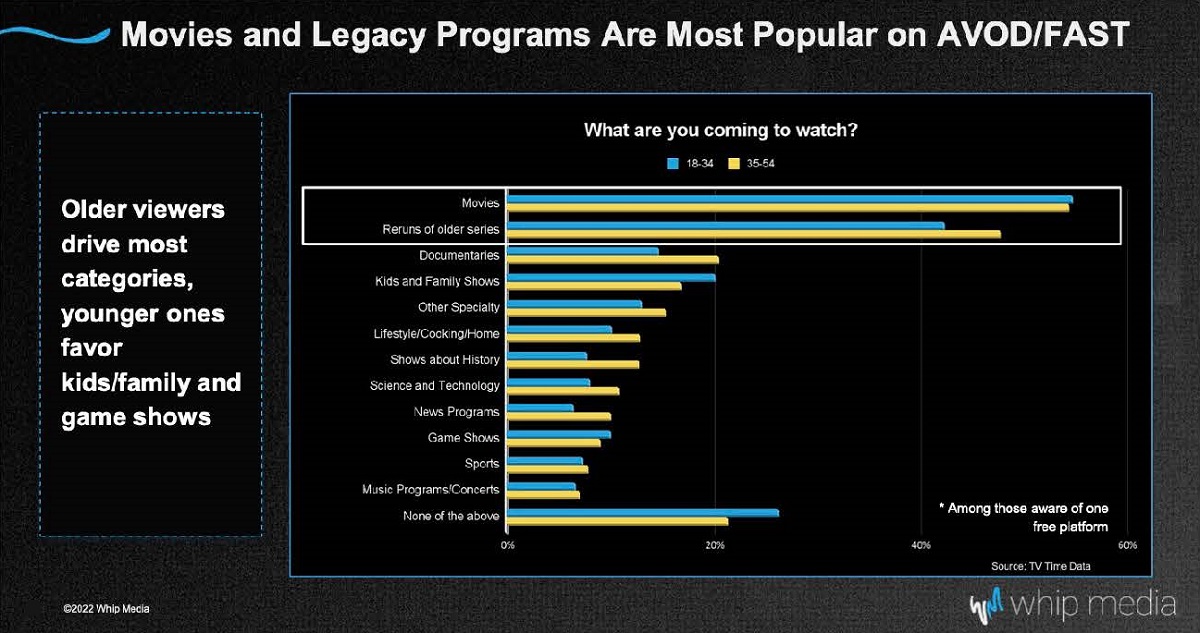

That FAST is the new cable makes sense at a very basic level in that both had the same original business model: take older library content that still has an audience and run advertising against it.

The Data Difference

More than anything else, it is data that distinguishes the FASTs from the cable channels of the 80s, where most programmers were flying blind.

Today’s programming executives can look at a broad range of data to determine which genres are likely to keep viewers on the platforms for longer periods of time, which genres advertisers seem to prefer, which genres result in viewers returning to the app.

“The biggest difference between today and the early days of cable is we have so much more data now to draw on and so companies have real time feedback. So things are improving much, much, much faster than they once did,” says Srinivasan KA, co-founder of Amagi, which sponsored the report. “People are experimenting more and things that don’t work are being thrown away. So it’s maturing much, much faster and the iterations are much faster too.”

Vizio has data from more than 20 million opt-in Vizio devices. Katherine Pond, Group VP of Platform Content and Partnerships at Vizio, explains, “We use data for everything from deciding which shows to surface, provide more relevant entertainment content options and recommendations for users and enable our partners to understand key insights that can help shape future programming and which audience segments they’re resonating with.”

For both cable and the FAST channels, the answer as to why they succeeded seems to be pretty simple: people liked having access to comfort food TV of the sort they could have on as background. Plus, it felt personal — this was something only you were watching, no one else was going to be talking about it at work the next day.

“In the current ecosystem, the feeling is that FASTs operate as a counterweight to the big SVOD services,” TV Rev reports.

Curated Channels vs. Licensed

While some rights holders are trying to self-curate their own channels that they can license directly to the FASTs, the FAST executives are leery of this approach as they prefer to curate their own channels. This allows execs to remain truer to their brand and ensures that their ability to curate channels is a value-add to both users and programmers and, most important, is what sets them apart.

The curated channels are also successful; Samsung TV Plus, for example, has had so much success with its curated channels that it is doubling the size of what it calls its “owned and operated” library while rolling out more curated channels around topics like cooking, DIY and autos.

“In the current ecosystem, the feeling is that FASTs operate as a counterweight to the big SVOD services.”

— TV Rev

That said, FAST platforms will occasionally license channels directly from distributors, but only with channels they feel will perform well due to prior demand or channels where curation is not necessary, like news channels.

“The goal of all of the linear channels on the FASTs — curated and licensed — is to keep viewers engaged and to provide the same sort of programming magic that made certain cable channels stand out back in the day.”

SVOD Goes Linear, Too

TV Rev research reveals an assumption that the SVOD services will all roll out their own linear channels in the next year. Three of the majors — Paramount+, Discovery+ and Peacock have already done so.

The rationale most often proffered is summed up in a paraphrased quote that echoes the opinions of many of the executives TV Rev surveyed: “If someone is going to binge watch Friends every night, why would I make them choose from over 200 episodes every time, when I could just give them a Friends channel?”

Another common theme identified in the report was that while the SVOD services had substantial libraries, they tended to concentrate their promotional activity on their originals so viewers were either unaware of the extent of their library content or felt that they should be spending their time watching originals instead.

Either way, linear channels would help to solve this problem and would help surface streaming companies’ extensive libraries so that viewers felt they were getting more out of their subscriptions.

“The biggest difference between today and the early days of cable is we have so much more data now to draw on and so companies have real time feedback. So things are improving much, much, much faster than they once did. People are experimenting more and things that don’t work are being thrown away. So it’s maturing much, much faster and the iterations are much faster too.”

— Srinivasan KA, Amagi

A final rationale for SVOD linear channels is that they can hold a larger ad load.

The assumption is that SVOD services will try and keep ad loads very low on their originals, with some (Netflix) possibly limiting them to pre-roll. By adding in more ad slots on their linear channels, SVOD services would be able to increase their limited supply while offering a lower CPM option for brands that were shut out of their higher priced originals.

TV Rev points to the “flywheel effect” in which SVODs use the FAST service to promote original programming on the subscription services so that viewers sign up… while at the same time keeping the FAST channel original and engaging so that viewers see it as a destination in its own right.

VOD is Not Going Away

That said, VOD is not going anywhere either. While we have heard people refer to “a FAST” to refer to a linear channel — ouch! — the reality is that all of the aggregators maintain both linear and VOD content.

This is just common sense. Why wouldn’t you cater to viewers’ different needs and wants, especially when those needs and wants vary depending on mood or time of day?

There are two components to Vizio’s WatchFree+ service, for example, including 250 free streaming channels, plus an on-demand portion with more than 5,000 assets.

Developments to Look Out For in FAST

FASTs are going to continue growing and with them the ability to handle DRM (digital rights management) issues will be critical as different players have different rights in different markets.

FASTs may also strike deals with some of the big SVOD services to promote their programming in exchange for some form of revenue split if the viewer signs up for the service on an app on the OEM’s device.

“Whoever controls the interface for the TV also controls which apps are allowed on the interface, which means they get to wield a great deal of power and become the new gatekeepers for the streaming ecosystem. This gives them a lot of power over the FASTs, similar, in fact, to the power the MVPDs once had over cable networks.”

— TV Rev

Practically, this means that, say, VIZIO might run one or two episodes of a new Netflix original while offering new viewers who sign up for Netflix on VIZIO a discount on the first year’s subscription.

TV Rev also predicts the emergence of personalized linear channels. In fact it did this back in 2015, and now it is even more certain.

“Linear channels plus superior viewer data should allow at least one FAST to experiment with a channel based on prior viewing habits — something similar to the way Spotify creates personalized playlists based on your recent listening selections. It’s certainly worth a shot and if successful, would increase engagement.”

The analyst also expects to see live sports on the FASTs — not from the major sports leagues, but rather from smaller leagues like minor league baseball, smaller NCAA conferences and niche sports like field hockey and lacrosse.

“While many of these sports already have some sort of broadcast deal, they will find a more welcoming home on the FASTs — live sports will be a key point of differentiation for them — not to mention the greater interactivity that comes with digital delivery.”

Look for features like stats overlays and multiple camera angles. In fact, a few people in the report research suggested that FASTs would become testing grounds for new interactive sports features before they are rolled out before a bigger national audience during an NFL game.

The TikToking of the FASTs

Finally, TV Rev makes the interesting observation that TikTok “sort of qualifies as a FAST.”

TikTok has launched apps on the big three smart TV OEMs (Samsung VIZIO and LG) as well as on Amazon Fire TV and Android TV.

“Given that it is both free and ad-supported, it falls into the same gray area as YouTube because it’s short-form and often user-generated.”

“While ‘FAST Channel’ is most definitely the term currently used to describe linear channels on FAST services, the appearance of linear channels on SVOD is likely to result in a shortening of that term to ‘Channel’ across both business models.”

— TV Rev

TV Rev believes there’s some potential for creating linear channels out of TikTok content, grouping, say, stand-up and other comics all together and creating 30 minute “shows” out of 10 three-minute clips.

“[There’s] no reason to think that would not be a popular way to package TikTok and Instagram Stories type videos… if (and it’s a big if) those platforms and their influencers will agree to it.”

The key here will be watching to see how much of TikTok’s viewing shifts to television sets from smartphones and how that affects the desire for similar channels on the FASTs.

The FAST Model Goes Global

If major streamers seek total world domination (which they do) they aren’t going to get there using SVOD alone. Even an ad-supported SVOD is unlikely to gain much traction in emerging economies, TV Rev finds.

“Free ad-supported TV promises to become the dominant business model globally. That’s because in most of the world, few people have the sort of disposable income needed to support a subscription TV service.”

But what will be interesting is when services like Netflix, which had resisted launching an ad-supported tier on principle, realize that they will also need a free tier to gain audiences in most of the 125+ countries they’ve planted their flag in.

TV Rev thinks the key to success will be incorporating local players into the FAST services, either via outright purchases or by launching joint ventures.

In addition, relying on local knowledge can help American companies to navigate language and cultural issues they may not be aware of.

READ MORE: FASTs Are The New Cable (TV Rev)

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV offers a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- Connected TV Takes Over the World

- Connected TV Is the New TV, and That’s Where We Are

- FAST TV and SVOD Are “Channeling” the Cable Business Model

- More Consumers Are Headed Into the FAST Lane

- SVOD vs. AVOD Today, All Connected TV Tomorrow

- Ways Pay TV Operators Can Win the SVOD Game

Next, Watch This

Here, streaming experts gathered for a roundtable discussion hosted by The Wrap said they expect the looming recession will push consumers into FAST, “long stereotyped as a haven for a financially struggling Gen Z audience.” As premium services pivot to include ad-supported tiers to offset subscriber churn and slower-than-predicted growth, FAST services like Pluto, Tubi and Amazon’s Freevee are well-positioned to begin including premium content into the mix. Watch the entire conversation in the video below: