READ MORE: SVOD vs AVOD: How Consumers are Watching Connected TV (Mountain Research)

The rise in use of ad-supported streaming TV services continues with fresh data showing the line between SVOD and AVOD fading as the cost of living for households tightens. Around 25% of US internet users already watch a combination of AVOD and SVOD channels, according to Ampere Analysis.

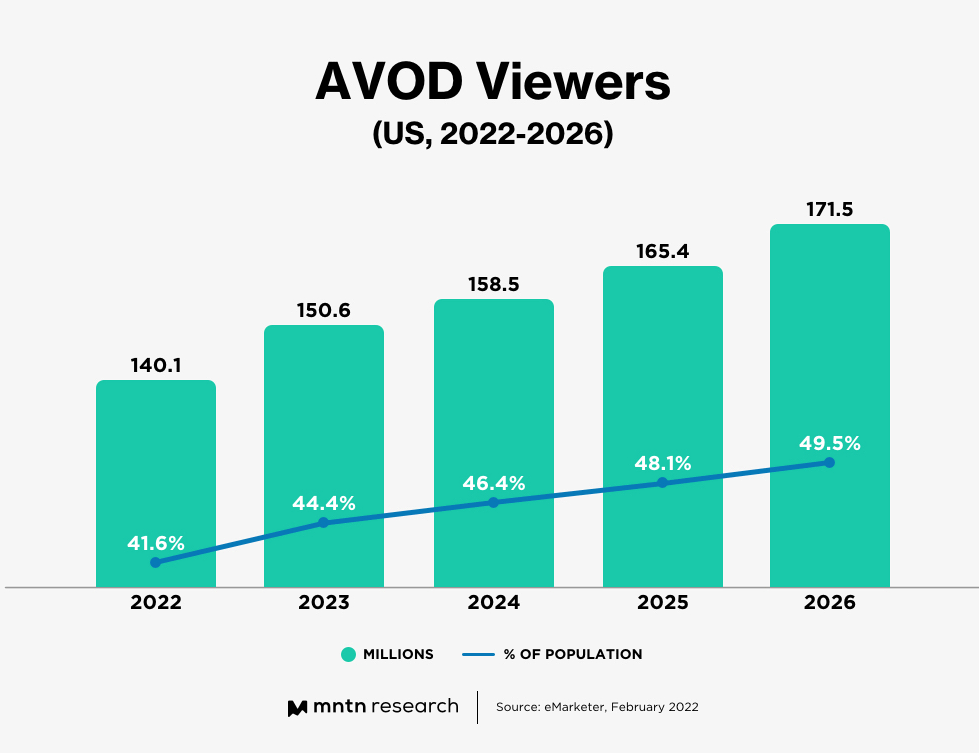

READ MORE: Report: 50% of U.S. Population to Stream AVOD Content by 2026 (Media Play News)

WATCH THIS: TheGrill: Focus on AVOD presented by FilmRise

As inflation rises toward a possible recession and consumers continue to tighten their belts, ad-supported video-on-demand — including FAST channels — are quickly becoming the norm.

WrapPRO recently convened a panel of industry experts to discuss consumer habits amid the rise of AVOD as part of its symposium, “TheGrill: Focus on Streaming presented by FilmRise.”

Moderator Brandon Katz was joined by Daniel Christman, SVP of cross platform group at Screen Engine/ASI; Tejas Shah, SVP of commercial strategy and analytics at FilmRise; Katina Papas Wachter, head of ad revenue strategy at Roku; and Alysha Dino, senior director of publisher development at Publica.

The rise of AVOD could create favorable conditions for both producers of advertising and delivery platforms, Christman commented, kicking off the discussion. “There just isn’t an overwhelming urge among consumers to add more paid subscriptions to their monthly budgets, especially as we head into all this recession talk,” he says. “And we know the demand for content is as great now as ever. So this sets up as an extremely favorable story for those involved in ads content creation, and delivery.”

Watch the full conversation in the video below:

READ MORE: ‘The Great Shift to AVOD’: Why Viewers Are Flocking to Ad-Supported Streaming (WrapPro)

Streamers have also been increasing the number of services they subscribe to every year, leading them to find ways to watch content at a lower price point if possible. A report from Nielsen found that 18% of Americans subscribe to four streaming services right now, and 93% plan to either add another paid streaming service or keep the same number in the future. That means the growth in the number of streaming services that provide ad-supported content and the consumers who are watching that content are both rising.

READ MORE: State of Play: The video streaming industry has reached a tipping point (Nielsen)

Mountain Research has a decent roundup of the latest surveys, reports and predictions on this front.

Click here to view a larger version of this graphic.

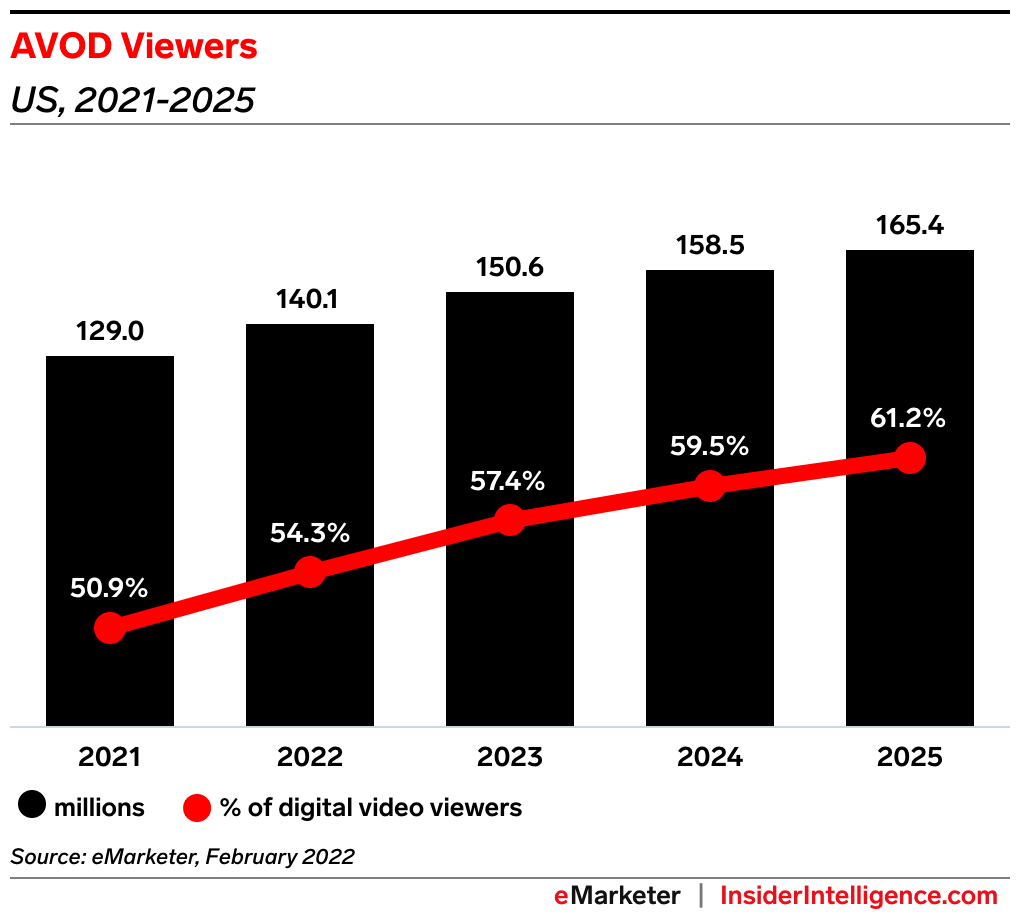

The number of AVOD viewers in the US will rise to 140.1 million this year, according to eMarketer, which by the end of 2022 will make up more than 54.3% of all digital video viewers in the country.

READ MORE: AVOD viewers make up more than 50% of US digital video viewers (eMarketer Insider Intelligence)

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities

In part this is because SVODs have had to respond by launching their own ad-supported options. Of the major streamers in the US, Hulu has always had both ad-free and ad-supported tiers for viewers while Paramount+ and Peacock launched with ad tiers during the pandemic.

HBO Max followed up this year, and Disney+ and Netflix are preparing to launch their own versions. Warner Bros. Discovery indicated an interest in an ad-supported tier, stating in their Q4 2021 earnings call that the free tier would help them reach more people and make use of content that paying subscribers aren’t watching as much.

READ MORE: Warner Bros. Discovery’s Streaming Service Learns Peacock Could Soon Offer Free Ad-Supported Tier (eMarketer Insider Intelligence)

Even with AVOD’s recent gains in audience signups and time spent, SVOD platforms are still the leaders in the Connected TV space. SVOD account for 53% of all streaming time, and around 220.1 million viewers in the US. By 2026, eMarketer expects that that number of viewers will rise to 238 million.

READ MORE: AVODs Now Account For 25% Of Streaming Consumption (MediaPost)

READ MORE: US Over-the-Top (OTT) Video Service Users (eMarketer Inside Intelligence)

It’s no surprise then that advertising dollars are following eyeballs, and most of the spend will head to Connected TV where consumers can mix and match AVOD, with FAST and SVOD.

A report from Amazon found that connected TV viewers average higher levels of income than the general population, giving them more purchasing power than their counterparts. They also are more willing to research brands that interest them, and once they find a company that they like, connected consumers will tend to stick with them for future purchases.

READ MORE: Generational Breakdown: Who is Watching Connected TV? (Mountain Research)

Streaming experts gathered for a round table discussion hosted by The Wrap said they expect the looming recession will push consumers into FAST, “long stereotyped as a haven for a financially struggling Gen Z audience.” As premium services pivot to include ad-supported tiers to offset subscriber churn and slower-than-predicted growth, FAST services like Pluto, Tubi and Amazon’s Freevee are well-positioned to begin including premium content into the mix. Watch the entire conversation in the video below:

Nielsen also found that AVODs tend to attract more diverse audiences than both traditional linear TV and SVODs — 36% of Pluto TV’s viewing audience and 39% of Tubi’s are Black, over twice as many as linear TV (17%).

READ MORE: Over half of consumers want a streaming bundle option (eMarketer Inside Intelligence)

READ MORE: Linear TV Advertising versus Performance TV (Mountain Research)

Ultimately, as service providers aggregate these services to make signing up and finding content across services frictionless, all of this will become just TV again. It may be that in a few years we won’t be needing to assign acronyms for each move of a streamer’s business model.