8K TV displays are barely on the consumer’s radar anywhere outside Japan but by 2030 they will be as mainstream as 4K TVs are today and HD sets were a decade ago.

There’s an inevitability about the growth of 8K sets in the home as the baseline continues to crawl upwards.

Following a slower than expected 2020 when just under 350,000 8K television sets were sold globally, Strategy Analytics is forecasting sales of more than 1 million 8K TVs this year and that this will quadruple in 2022.

By 2025, North America will have close to 25 million households owning at least one 8K TV set, according to the analyst.

The economic uncertainty and inability to get to shops led to a slack market for TV set sales last year but this expected to rebound — not least because stay-at-home orders caused many people to renew their relationship with the living room screen and may wish to upgrade.

That won’t translate into many 8K UHD displays sales of course, but the more we buy 4K TVs (and it is hard to buy an HD one) the higher the bar will be raised.

Consumer desire for ever larger screens is considered the principal driver.

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities

According to David Watkins, Director, Connected Home Devices at Strategy Analytics, “As we saw with 4K, TV panel manufacturers are likely to switch entire production lines over to 8K as soon as it makes financial sense to do so. This transition will start with the very large screen sizes over 70-inches before trickling down into the 60 to 69-inch and even into some sub 60-inch sizes.”

By the end of 2025, he adds, anyone looking to buy an ultra-large screen TV will have an increasingly hard time finding one that is not 8K. At CES this year, leading brands Samsung and LG expanded their 8K TV ranges.

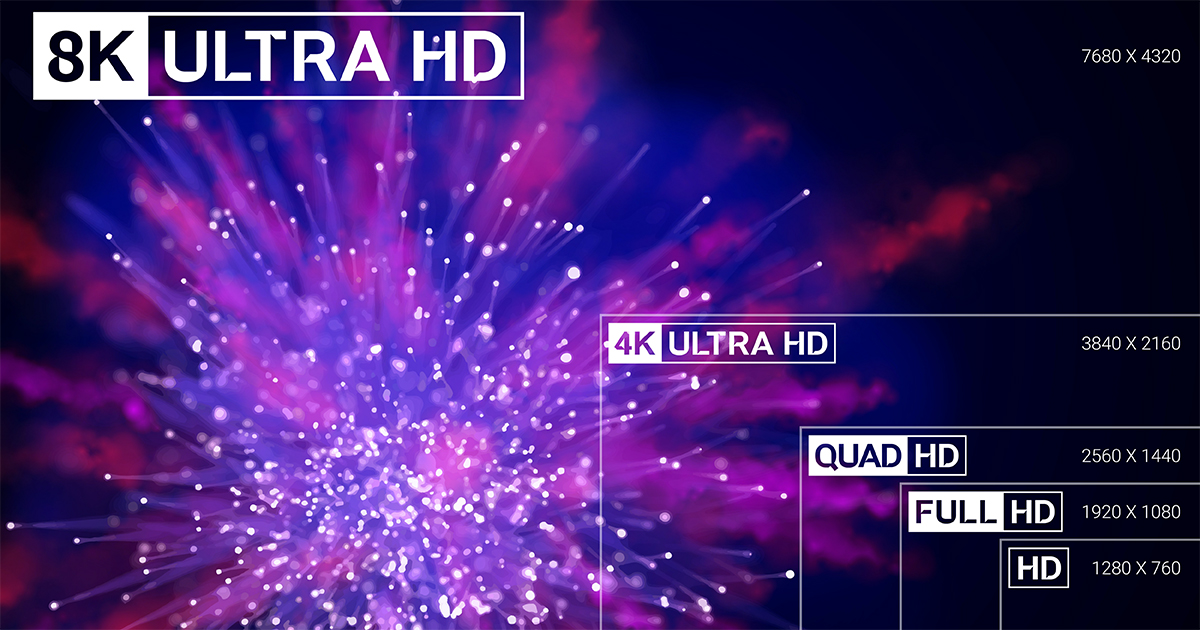

Screen size is important for 8K since it’s widely considered a waste of time (and space) to have anything smaller than a 50-inch set in order to discern any difference in pixel quality.

These predictions chime with those of another respected analyst, Omdia. It said (last December) that it expected between 250,000 and 300,000 8K TVs to ship in 2020, with around 600,000 in 2021. Omdia analyst Paul Gray said, “If we get to the million mark, it would need the Chinese market to take off.”

According to Omdia’s figures, about 19,000 sets of 8K TVs were sold in 2018. The figure increased by 100,000 in 2019 and reached more than 250,000 in 2020. In itself, it is staggering growth, but in comparison to 4K, the technology has a long way to go to catch up.

Indeed Q3 2020 saw the highest-ever third quarter result for TV set unit sales, charted by Omdia. Of the 62.9 million total, displays with UHD resolutions accounted for 58.6% but 8K TVs only represented 0.22% of these.

The relative surge in 8K TV sales between this year and next might be attributed to the Olympics double header. The Tokyo Games is chased by the Winter Games from Beijing next February and both will be heavily covered in 8K.

No broadcaster outside of Japan’s NHK is regularly airing content in the format and while an increasing number of feature film and series drama are being captured in 8K, plans to launch a 8K streaming service make little sense without a critical mass of sets in the market.

That Catch-22 will be broken. British broadcaster BT Sport has already made noises about 8K live transmissions and might already be doing so but for the problems of getting technicians into Premier League grounds this past season. The costs of 8K TV sets are also coming down to around US $3,000 (from $12,000 in 2017), according to Deloitte, with entry-level units available for less than that.